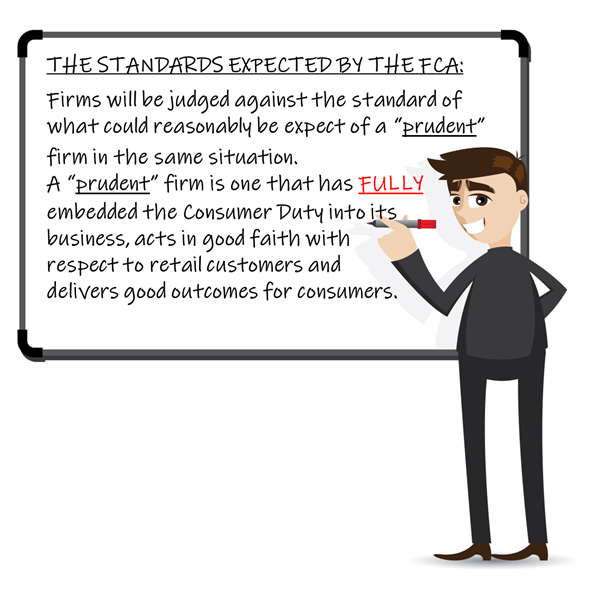

The entire Consumer Duty is underpinned by the concept of reasonableness. This is an OBJECTIVE test. It means that the rules and guidance laid down by the Consumer Duty must be interpreted in line with the standard that could reasonably be expected of a prudent firm:

- carrying on the same activity in relation to the same product or service, and

- with the necessary understanding of the needs and characteristics of the customers in the relevant target market.[1]

A “prudent” firm is one which has FULLY embedded the Consumer Duty, acts in good faith to meet its requirements, complies with all other relevant laws and delivers good outcomes for consumers.[2]

The Consumer Duty DOES NOT create an absolute obligation. Put simply, it DOES NOT mean that individual customers will always get good outcomes or that customers will always be protected from poor outcomes or all potential harms. It also DOES NOT impose an open-ended duty that goes beyond the scope of the firm’s role and its ability to determine or influence customer outcomes.[3]

What is ‘reasonable in the circumstances’ will depend on a number of factors, including the role of the firm and its influence on retail customer outcomes. This is a matter of fact and is not solely determined by reference to the contractual arrangements in place between firms in a distribution chain.[4] However, it is expressly recognised that a firm that is remote from a retail customer, and which has no direct client relationship, may have more limited obligations under the Consumer Duty.[5]

What is ‘reasonable’ will also depend on:

- the nature of the product being offered or provided,

- the characteristics of their retail customers, and

- the firm’s role in relation to the product.

The nature of the product being offered or provided

In determining what is “reasonable” in the circumstances, firms should consider the RISK OF HARM to retail customers. For example, if a product is higher risk, firms should take additional care to ensure it meets retail customers’ needs, characteristics and objectives and is targeted appropriately.

Firms should also consider the product’s relative COMPLEXITY. Retail customers may find it more difficult to assess the features, suitability or value offered by more complicated products. Other elements of a product which may contribute to its complexity would include long-term maturity where the outcome is not easy to predict and non-standard charging structures. Factors such as this would require firms to take greater care.

It almost goes without saying, but firms should also consider the costs, fees and charges involved with the product as well as the relative utility to retail customers of the product (as a whole but also of specific features) particularly if these are subject to separate fees or charges.

The characteristics of the retail customer(s)

In determining what is “reasonable” in the circumstances, firms must give consideration to the characteristics of their retail customer(s) (both those they know about and those they should reasonably have known about). In particular, firms should consider their:

- reasonable expectations in relation to the product,

- resources,

- degree of financial capability or sophistication, and

- characteristics of vulnerability.

The firm’s role in relation to the product

In determining what is “reasonable” in the circumstances, the firm must give consideration to its role in relation to the product. This includes:

- the firm’s relationship with the retail customer,

- whether the firm has provided or will provide advice to the retail customer (what is reasonable may be different where advice is being provided),

- the firm’s role in the product’s distribution chain (in particular whether it can determine or materially influence outcomes for retail customers in relation to the product), and

- the stage in the firm’s relationship with the retail customer. There will be times when retail customers are particularly exposed to harm, for example when they fall into arrears or are considering long-term investment decisions. The actions a firm needs to take to be acting reasonably in such circumstances may be greater than when a retail customer is making decisions which carry a lesser risk of adverse outcomes.[6]

Acting in a way that could reasonably be expected of a prudent firm requires more than adopting a single solution that is reasonable. It includes (among other things) considering whether the preferred solution provides good outcomes for all retail customers affected or only some – and if only some, why it does not work for all, and how best to identify additional actions which might mitigate the outcome for those adversely affected.[7]

The requirement to act ‘reasonably’ does NOT create a fiduciary duty in and of itself

Acting reasonably does not require a firm to assume a fiduciary duty or require an advisory service where it does not already exist.

Next time

Next time we will turn to look at the products and service outcome, so stay tuned!

[1] FG22/5, 1.4; Policy Statement PS22/9, 4.8, PRIN 2A.7.1R

[2] Policy Statement PS22/9, 4.11

[3] FG22/5, 4.11

[4] Policy Statement PS22/9, 2.14

[5] Policy Statement PS22/9, 2.14

[6] PRIN 2A.7.2G

[7] PRIN 2A.7.3G