What is “value”?

“Value” is the relationship between the amount paid by a retail customer for a product and the benefits they can reasonably expect to get from the product. A product provides fair value where the amount paid for the product is reasonable relative to the benefits of the product.[1]

Product manufacturer fair value assessments

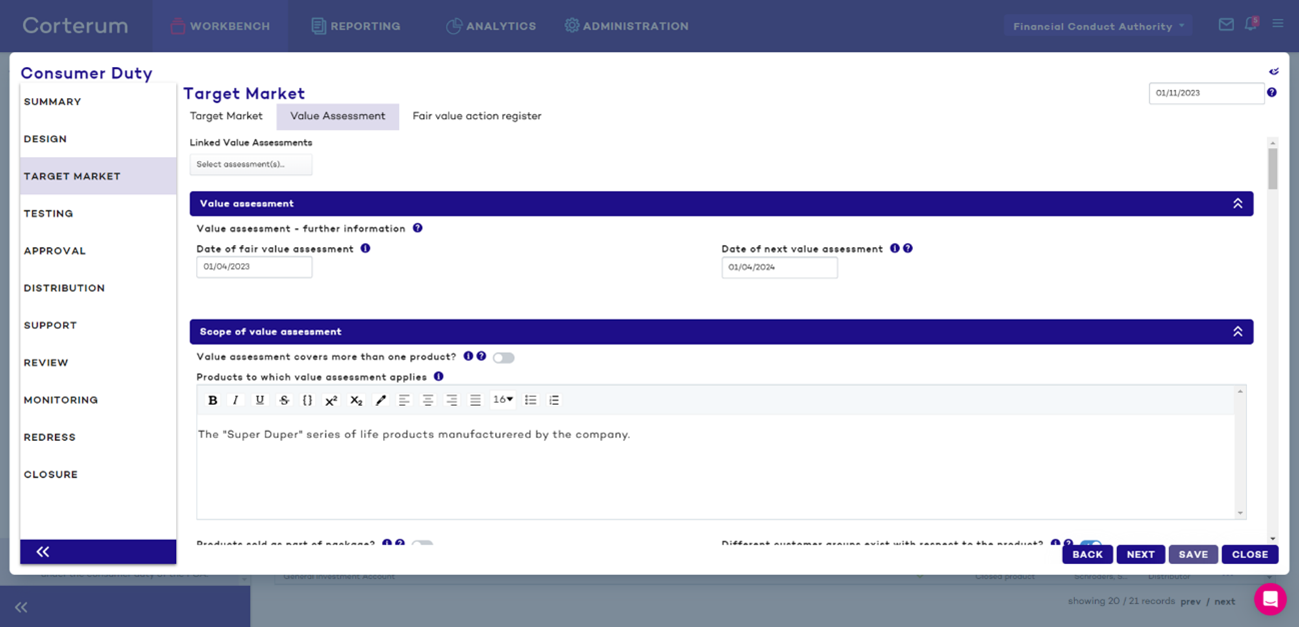

Product manufacturers must conduct fair value assessments with respect to each of their products or services.[2] Note that the assessment is only needed at the level of the product or service itself. There is no requirement to review individual existing contracts.[3] Moreover, customers do not need to be moved onto the latest product version in order to ensure fair value. The focus should be on ensuring that the product or service offers fair value on its own merits.

The purpose of a fair value assessment is to enable the manufacturer to understand (and demonstrate) whether there exists a reasonable relationship between the total price of the product or service in question and the benefits the customer receives, and specifically, whether that relationship constitutes fair value.

Timing of product manufacturer fair value assessments

Product manufacturers must assess value at every stage of the product approval process (i.e. before offering products or services to consumers). [4] In particular, fair value assessment should be conducted when:

- designing a product,

- identifying retail customers in the target market for whom the product needs to provide fair value, and

- selecting distributions methods/channels.[5]

Product manufacturers must also monitor and assess “value” throughout the life of a product or service, conducting regular reviews of value assessments.[6] Manufacturers must consider how regularly to perform ongoing fair value assessments based on relevant factors, such as the nature and complexity of the product or service, any indicators of customer harm, the distribution strategy and any relevant external factors.[7]

A fair value assessment should also be conducted following any significant adaptation of a product (but before it is re-marketed or re-distributed).[8]

Fair value assessments and the concept of “reasonableness”

As with the entire Consumer Duty, the price and value outcome rules (under which fair value assessments are mandated) apply based on what is “reasonable”. As such, the nature of the fair value assessment and the data and insight firms use to inform that assessment will vary depending on the type of product or service, and the size and complexity of the firm.[9]

Fair value assessments and products sold as part of a package

Where products and/or services are sold together as part of a package, firms must ensure that each component product or service, as well as the overall package, provides fair value.[10]

Fair value assessments and grouping of similar products

When carrying out fair value assessments, firms may group similar products together where the customer base, complexity and risk of consumer harm are sufficiently similar. However, firms should not do this if it could impair their ability to assess each product or service adequately.[11]

The concept of “price” in the context of fair value assessments

When considering the concept of “price”, product manufacturers must consider all the costs and charges a consumer may pay for the product or service over time. This includes:

- the charges consumers pay at the start and end of a contract,

- all fees and charges which consumers may incur over the life of the product or service. These may include contingent charges, like fees as a result of late payments/arrears (this is especially important if the target market includes consumers with poor credit rating), and

- with respect to products and/or services intended to be sold together as part of a package, the value of each component and the overall value of the package.[12]

Firms also need to consider whether consumers will incur other costs which may not be financial, such as:

- the time and effort it takes to access, assess and act to buy, amend, switch or cancel a product, and

- the firm’s use of consumer data where consumers knowingly or unknowingly ‘pay’ with their data, privacy or attention.[13]

A product or service that doesn’t meet any of the needs of the customer it is sold to, causes foreseeable harm, frustrates the objectives of customers or has negligible or no obvious benefits for consumers is unlikely to offer fair value whatever the price.[14]

What are “benefits”?

In order to perform a fair value assessment, product manufacturers must assess the benefits (both financial and non-financial) consumers can reasonably expect from a product or service.[15]

Characteristics such as the quality of the product or service, the level of consumer service, the potential pay-out or return, how well the product meets consumers’ needs, or other features that consumers find valuable, all constitute “benefits” against which the price of the product should be assessed.[16]

Firms are not necessarily expected to quantify non-monetary costs and benefits. However, they are expected at least to provide qualitative consideration of these factors.[17]

Fair value assessments in relation to free products

Manufacturers who provide free products or services should still consider if their customers are paying in non-monetary terms, and whether those costs are reasonable in relation to the product’s benefits.[18]

Where a product or service does not have any financial or non-financial cost to the consumer (e.g. debt advice funded through other sources), there is no requirement to perform a fair value assessment.[19]

Factors to consider in any fair value assessment

Firms have the discretion to decide on the factors they use in their fair value assessments, provided those factors allow the firm to demonstrate that there remains a reasonable relationship between the total price of the product or service and the benefits the customer receives.[20] In preparing a fair value assessment, firms should not rely solely on data relating to individual consumers.[21]

The FCA states that firms must consider at least the following:

- the nature of the product or service, including the benefits that will be provided or may reasonably be expected and their qualities,

- any limitations that are part of the product or service (for example, limitations on scope of cover for insurance products),

- the expected total price customers will pay, including all applicable fees and charges over the lifetime of the relationship between customers and firms,[22] and

- any characteristics of vulnerability that retail customers in the target market display and the impact these characteristics have on the likelihood that retail customers may not receive fair value from its products.[23]

Other factors a firm could consider include:

- the costs incurred to manufacture and/or distribute the product or service (this may help to explain why otherwise similar products are priced differently, and/or explain changes in the price charged over time),

- the market rates and charges for comparable products or services (where a product or service is a significant outlier, it might prompt the firm to confirm they are still confident the price is reasonable compared to the benefits received),

- whether there are any products in the firm’s portfolio which are priced significantly lower for a similar or better level of benefit,

- any accrued costs and/or benefits for existing or closed products,[24] and

- depending on the nature of the product or service, customer research, testing or use of internal data.[25]

Fair value assessments for target markets comprised of different groups

In conducting a value assessment in circumstances where different groups of retail customer exist within the target market, product manufacturers should have regard in particular to:

- whether any retail customers who have characteristics of vulnerability may be less likely to receive fair value, and

- whether the product provides fair value for each of the different groups of retail customer in the target market, including in circumstances where the pricing structure of the product involves different prices being charged to different groups of retail customers.[26]

In considering “fair value”, it is permissible for firms to charge different prices to different groups of consumers within the target market. However, firms must consider whether the price charged for the product/service provides fair value for customers in each group, while having regard to whether any customers who have characteristics of vulnerability may be disadvantaged.[27]

For how long must a product manufacturer fair value assessment remain valid?

A product manufacturer must be satisfied that the product/service in question will continue to provide fair value from the point at which the manufacturer completes the assessment for a “reasonably foreseeable” period, including, where the product is one that renews, following renewal.[28] What constitutes a ‘reasonably foreseeable period’ will depend on the type of product.[29]

Fair value assessments should be forward-looking

The assessment of whether a closed product or an existing product provides fair value should be on a forward-looking basis only.[30] It should take into account the benefits provided, the costs charged to the retail customer and the costs incurred by the firm prior to the rules regarding the Consumer Duty coming into effect.[31]

What if a manufacturer is already subject to “fair value” rules?

Firms that are already subject to fair value rules (such as PROD 4 for non-investment insurance or PROD 7 for funeral plans) will meet the price and value outcome of the Consumer Duty by complying with those existing rules.[32]

What if a manufacturer concludes that a product or service DOES NOT provide fair value?

If a product or service does NOT provide (or ceases to provide) fair value to customers, firms must take appropriate action to mitigate, prevent and (where appropriate) remediate harm, for example, by amending the product or service to improve its value or withdrawing it from sale.[33]

Monitoring and record keeping in relation to fair value assessments

Firms must get all necessary information to enable them to understand and monitor consumer outcomes, including value assessments performed in relation to the price and value outcome.

At a high level, firms must be able to clearly demonstrate how any product or service provides fair value.[34] To this end, they should:

- record factors considered in their fair value assessments,

- collect and analyse appropriate management information (MI), and

- be able to provide evidence if requested to do so by the FCA.[35]

Examples of the types of data which firms could monitor to ensure that they comply with their obligations with respect to fair value assessments could include:

- the expected price paid by customers, including associated fees and charges and those incurred further down the distribution chain,

- profitability data, including revenue and profit margins,

- customer complaints and root cause analyses,

- surveys, net promoter scores, social media rating analysis, focus groups, mystery shopping or other customer research,

- data about customer usage and behaviour, such as transactional data, retention rates or relevant A/B testing of variation in product or service design,

- operational data which might affect value such as on app or website outages or service call abandonment rates,

- feedback from other firms in the distribution chain including, manufacturers, intermediaries, appointed representatives or other third parties regarding the value of the product,

- the cost of providing the product or service, including credit risk, and

- market conditions, such as the interest rate environment or rates for comparable products.[36]

Fair value assessments in the context of collaborations between product manufacturers

Where firms collaborate to manufacture a product, they must set out in a written agreement their respective roles and responsibilities in the fair value assessment process.[37]

Provision of fair value assessment information to product distributors

The manufacturer of a product must ensure that firms distributing a product have all necessary information to understand the value that the product is intended to provide to a retail customer.[38]

Product distributors and fair value assessments

General

Distributors are NOT required to duplicate fair value assessments performed by manufacturers. Each firm is only responsible for the prices that they control. They are not required to re-do or to challenge any other firm’s fair value assessment.[39]

However, distributors are required to understand at least the benefits of the product to the target market, the price and associated fees and whether any of their or other charges result in the product ceasing to provide fair value.[40] This means that the distributor will need to consider the cumulative impact of the remuneration added by each person in the distribution chain on the overall value of the product to the customer.[41]

More generally, a distributor must not distribute a product unless its distribution arrangements are consistent with the product providing fair value to retail customers.

Where a product manufacturer sets the final price that the retail customer receives, including distribution charges (i.e., through commissions) then only the product manufacturer is responsible for ensuring that the product provides fair value. In these circumstances, the distributor does NOT need to carry out a fair value assessment (although it must confirm that the manufacturer has carried out a fair value assessment and review the information shared by the manufacturer to understand the benefits for the target market before they distribute).[42]

Timing of product distributor fair value assessments

A distributor must consider the fair value assessment when determining the distribution strategy for the product and in particular where the product is to be distributed with another product whether as part of a package or not.[43] In addition, all distributors must regularly review distribution arrangements throughout the life of a product to ensure that they remain consistent with the product providing fair value to retail customers in the target market.[44]

Distributor obligations to perform fair value assessments for non-UK manufactured products

If a product is developed outside the UK (and therefore may not be subject to the requirements of the Consumer Duty), distributors must still take all reasonable steps to understand:

- the benefits of the product or service to the target market,

- any limitations of the product, and

- whether their or any other charges added along the line cause the product to become unfair value.[45]

What if a distributor concludes that a product or service DOES NOT provide fair value?

Where a product distributor identifies that the product no longer provides fair value, whether that is due to aspects of the product or the distribution arrangements, it must take appropriate action to:

- mitigate the situation and prevent further occurrences of any possible harm to retail customers, including, where appropriate, amending the distribution strategy for that product,

- redress any foreseeable harm that has been caused to retail customers by faults in the distributor’s distribution arrangements, and

inform any relevant manufacturers and other distributors in the chain promptly about any concerns they have and any action the distributor is taking.[46]

Sharing of fair value assessments between manufacturers and distributors

In order to comply with the requirement to provide “fair value” to retail customers, as part of the distribution arrangements which product distributors enter into with product manufacturers, distributors must ensure that they are able to obtain enough information from the manufacturer to understand the outcome of the product manufacturer’s fair value assessment and in particular to identify:

- the benefits the product is intended to provide to a retail customer,

- the characteristics, objectives and needs of the target market,

- the interaction between the price paid by the retail customer and the extent and quality of any services provided by the distributor, and

- whether the impact that the distribution arrangements (including any remuneration it or (so far as the distributor is aware of it) another person in the distribution chain receives) would result in the product ceasing to provide fair value to retail customers.[47]

For their part, manufacturers should provide distributors with the results of their fair value assessments. However, they do not have to include sensitive information. It is acceptable for a manufacturer to share a high-level summary of the benefits to the target market, information on overall prices or fees and confirmation that the manufacturer considers that total benefits are proportionate to total costs.[48]

A firm which distributes products to other distributors must ensure that all information relevant to the value assessment is passed to the distributor at the end of the distribution chain. Firms in this situation must also consider whether they are actually a co-manufacturer of the product they are distributing. If they are, the manufacturer rules will apply.[49]

The price and value outcome: key questions for firms

Below are a set of questions which the FCA recommends firms consider in terms of managing their compliance with the price and value outcome:

- Is the firm satisfied that it is considering all the relevant factors and available data as part of its fair value assessments? Has it gathered relevant information from other firms in the distribution chain?

- What insight has the firm gained for its fair value assessments by benchmarking the price and value of its products and services against similar ones in the market? Have the price and value of its older products kept up with market developments?

- Can the firm demonstrate that its products and services are fair value for different groups of consumers, including those in vulnerable circumstances or with protected characteristics?

- If the firm is charging different prices to separate groups of consumers for the same product or service, is the firm satisfied that the pricing is fair for each group?

- What action has the firm taken as a result of its fair value assessments, and how is it ensuring this action is effective in improving consumer outcomes?

- What data, MI and other intelligence is the firm using to monitor the fair value of its products and services on an ongoing basis? How regularly is it reviewing this material, and what action is it taking as a result?[50]

Next time

Next time, we’ll be turning our attention to look at compliance with the Consumer Duty within the “Product Design” stage, so stay tuned!

[1] PRIN 2A.4.1R; Policy Statement PS22/9, 7.1

[2] Policy Statement PS22/9, 7.1; Policy Statement PS22/9, 7.8

[3] FG22/5, 3.13; Policy Statement PS22/9, 3.18

[4] FG22/5, 7.15

[5] PRIN 2A.4.19R; PRIN 2A.4.24R

[6] FG22/5, 7.16; FG 22/5, 7.45

[7] FG 22/5, 7.46

[8] PRIN 2A.4.3R

[9] FG22/5, 7.18

[10] FG22/5, 7.17; PRIN 2A.4.7R

[11] FG22/5, 7.19; Policy Statement PS22/9, 7.13

[12] FG 22/5, 7.25

[13] FG 22/5, 7.28; PRIN 2A.4.10G

[14] FG 22/5, 7.5

[15] FG22/5, 7.22; PRIN 2A.4.10G

[16] FG 22/5, 7.24

[17] Policy Statement PS22/9, 7.8

[18] Policy Statement PS22/9, 7.8

[19] FG 22/5, 7.20

[20] FG22/5, 7.13

[21] FG22/5, 7.12; PRIN 2A.4.20R

[22] FG 22/5, 7.9

[23] PRIN 2A.4.8R

[24] FG22/5, 7.10; PRIN 2A.4.9G

[25] FG22/5, 7.12

[26] PRIN 2A.4.11G

[27] FG 22/5, 7.38

[28] PRIN 2A.4.5R

[29] PRIN 2A.4.6G

[30] PRIN 2A.4.22G

[31] PRIN 2A.4.23G

[32] Policy Statement PS22/9, 7.12

[33] FG22/5, 7.14; FG22/5, 7.16; PRIN 2A.4.25R

[34] FG 22/5, 7.47

[35] FG 22/5, 7.48

[36] FG 22/5, 7.50

[37] PRIN 2A.4.13R

[38] PRIN 2A.4.15R

[39] Policy Statement PS22/9, 7.9; FG22/5, 7.31

[40] Policy Statement PS22/9, 7.9

[41] FG 22/5, 7.33

[42] FG 22/5, 7.35

[43] PRIN 2A.4.19R

[44] PRIN 2A.4.24R

[45] FG 22/5, 7.36

[46] PRIN 2A.4.27R

[47] PRIN 2A.4.16R; FG22/5, 7.32

[48] Policy Statement PS22/9, 7.9

[49] PRIN 2A.4.18R

[50] FG 22/5, 7.51